Philip Capital Management Sdn Bhd RECOMMENDATION: BUY

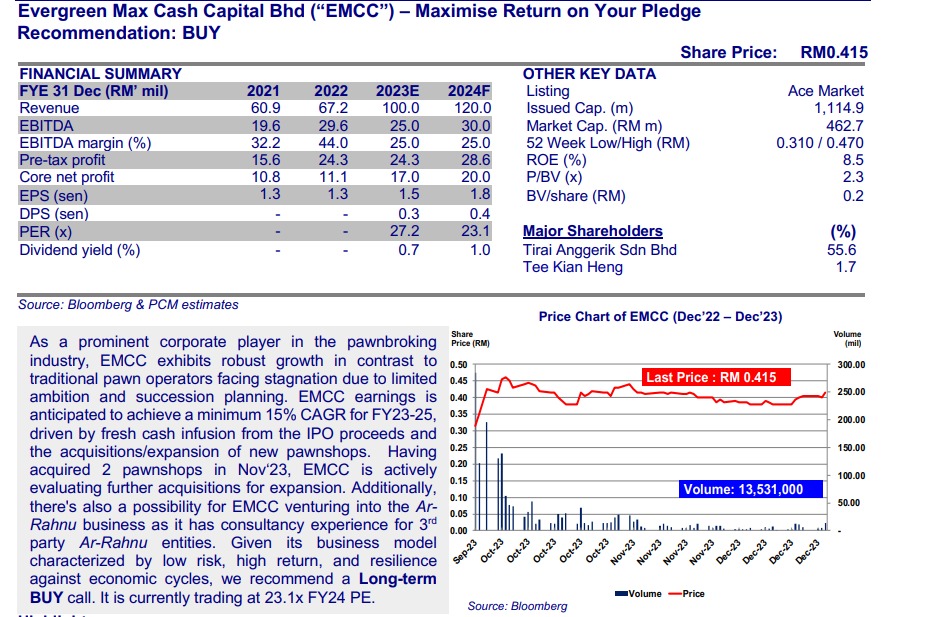

As a prominent corporate player in the pawnbroking industry, EMCC exhibits robust growth in contrast to

traditional pawn operators facing stagnation due to limitedambition and succession planning. EMCC earnings is

anticipated to achieve a minimum 15% CAGR for FY23-25,driven by fresh cash infusion from the IPO proceeds and

the acquisitions/expansion of new pawnshops. Having acquired 2 pawnshops in Nov‘23, EMCC is actively

evaluating further acquisitions for expansion. Additionally,there’s also a possibility for EMCC venturing into the ArRahnu business as it has consultancy experience for 3rd party Ar-Rahnu entities. Given its business model characterized by low risk, high return, and resilience against economic cycles, we recommend a Long-term BUY call. It is currently trading at 23.1x FY24 PE

For further reading, please click the link below